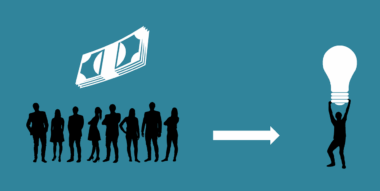

Challenges in Raising Capital through Equity Crowdfunding

Equity crowdfunding has gained traction as an alternative to traditional financing, yet businesses face several unique challenges. One major hurdle is the difficulty in reaching a broad audience. Unlike conventional fundraising, where established networks may exist, startups often struggle to find potential investors. This issue is compounded by the need for extensive marketing efforts to communicate their value proposition effectively. Another challenge is the regulatory framework surrounding equity crowdfunding, which varies across jurisdictions. This can create confusion for businesses attempting to navigate the existing laws. Furthermore, the process of preparing for an equity crowdfunding campaign demands a significant commitment of time and resources, which may overwhelm startups. They must develop comprehensive business plans that are not only compelling but also transparent. Additionally, businesses need to be ready for post-funding obligations, such as shareholder communications and ongoing compliance with SEC regulations. This lack of familiarity with such requirements may deter many potential entrepreneurs. Overall, overcoming these barriers is essential for businesses aiming to leverage equity crowdfunding as a viable financing option.

Building Credibility and Trust

Building credibility and trust is paramount to successful crowdfunding campaigns. In equity crowdfunding, businesses may struggle to establish themselves as trustworthy entities in the eyes of investors. This issue is particularly relevant for new companies without a proven track record or established brand reputation. Investors are cautious and seek assurance that their funds will be wisely invested, necessitating transparency in communication and disclosure of all relevant information. Furthermore, the existence of numerous scams and failed projects in crowdfunding has fostered skepticism among potential backers. As a result, businesses must put substantial effort into crafting a narrative that highlights their legitimacy and viability. Utilizing platforms that effectively aggregate reviews can enhance fostering of trust with prospective investors. Engaging with influencers and community members can also provide external validation. Moreover, creating detailed pitches that cover business models, revenue projections, and exit strategies helps to establish professionalism. By presenting a well-thought-out value proposition and open communication, businesses can address potential investors’ concerns. Ultimately, fostering credibility plays a crucial role in attracting necessary investments and ensuring campaign success.

Unclear valuation is another obstacle businesses encounter in equity crowdfunding. One pressing issue is the lack of standardized valuation metrics, which can cause uncertainty for both entrepreneurs and investors. Businesses often struggle to determine their worth, leading to potential conflicts when negotiating equity stakes. New companies may be overly optimistic about their valuations, while more experienced investors may offer lower estimates, creating tension. This discrepancy can hinder the fundraising process, as potential investors may hesitate to contribute if they perceive the offering as overpriced. Furthermore, showcasing a clear valuation is critical for gaining investor confidence, as it ensures transparency about the ownership stakes being sold. Companies are encouraged to seek guidance from financial experts to arrive at realistic valuations. Offering proper documentation showcasing past performance, sales data, and future projections can substantiate these valuations further. Additionally, businesses should be open to adjusting their evaluation based on investor feedback to ensure a smoother negotiation process. In conclusion, clarifying valuation can greatly enhance the investor’s perception, leading to a more successful fundraising outcome for businesses involved in equity crowdfunding.

Marketing constraints represent another significant challenge for businesses engaged in equity crowdfunding. Effective marketing is essential for generating investor interest, but many startups often lack the resources for comprehensive marketing campaigns. Conventional marketing channels may not yield the desired results, particularly if the target audience remains unaware of the crowdfunding platform being utilized. Startups might be required to develop creative marketing strategies that differentiate them from competitors and optimize limited budgets. Moreover, reliance on social media and digital marketing can be overwhelming for businesses without the necessary expertise. As a result, they may find it challenging to convey their unique selling proposition effectively. The presence of numerous campaigns competing for the same investor attention can create additional competition. Establishing a strong online presence and engaging with potential investors through consistent communication can help build a supportive community. Utilizing storytelling techniques and visual content may enhance marketing efforts as well. To summarize, addressing marketing constraints with strategic planning can elevate businesses’ chances of achieving successful campaigns in equity crowdfunding.

Managing Legal Compliance Issues

Legal compliance issues pose a major obstacle for businesses seeking to engage in equity crowdfunding. The legal landscape surrounding fundraising through crowdfunding platforms is constantly evolving, which can lead to confusion for entrepreneurs unfamiliar with these regulations. Adhering to the rules set forth by regulatory bodies, such as the SEC in the United States, is crucial for ensuring compliance. This adherence helps to protect both the investors and the businesses involved. Furthermore, businesses may require legal assistance to properly navigate agreements and potential liabilities that arise during the process. This necessity often adds to the overall campaign costs, creating financial burdens for startups already operating on tight budgets. Companies must also keep track of reporting requirements post-campaign, including communication with shareholders and ongoing disclosures. Failure to comply with legal obligations can lead to severe penalties, damaging the business’s reputation. Establishing relationships with legal professionals specializing in securities law can mitigate these risks. In essence, businesses aiming for equity crowdfunding must prioritize legal compliance to create a solid foundation for their fundraising efforts.

Post-Campaign Obligations

Once a successful equity crowdfunding campaign concludes, businesses face various post-campaign obligations that require careful consideration. Managing expectations among new shareholders can be a daunting task, particularly if investors anticipate immediate returns on their investment. Startups are often competing with established companies that have a track record, making it challenging to align new investors’ expectations with the startup’s growth trajectory. Clear communication and transparency become essential in addressing these concerns. Moreover, businesses must develop systems for ongoing shareholder communication, providing updates on financial performance and business milestones. Seeking continuous engagement with investors demonstrates accountability and builds trust. Additionally, companies might need to address operational changes as a result of newfound resources, leading to adjustments in company policies or hiring processes. These changes can also affect company culture and employee dynamics. Understanding and adhering to all legal requirements concerning shareholder rights is equally important. By addressing these post-campaign obligations, businesses can foster positive relationships with investors and create a strong foundation for future growth.

Lastly, competition is a continuing challenge for businesses involved in equity crowdfunding. The landscape is characterized by countless startups vying for a limited pool of investors, making it imperative for each business to find unique ways to stand out. This competitive environment demands strategic positioning to attract investor interest and attention. The presence of established players and successful fundraising campaigns may overshadow newer enterprises, creating additional pressure. Businesses must invest time and effort in refining their pitches to ensure they effectively communicate their vision, mission, and unique selling propositions. Incorporating diverse content formats, engaging visuals, and storytelling techniques can differentiate campaigns from competitors. Networking with industry professionals often leads to valuable insights and potential partnerships that can enhance visibility. Furthermore, monitoring emerging trends and investor sentiments can help businesses pivot their strategies accordingly. In conclusion, addressing competitive challenges and finding innovative ways to differentiate their campaigns is vital for businesses looking to succeed in equity crowdfunding.

Conclusion

In summary, equity crowdfunding offers unique opportunities for businesses but is accompanied by numerous challenges. From overcoming regulatory complexities to managing investor expectations, the road can be rocky. It is essential for entrepreneurs to understand the intricacies of equity crowdfunding to navigate these obstacles effectively. Building credibility and trust, clarifying valuation, addressing marketing constraints, and complying with legal obligations remain pivotal for fundraising success. Once the campaign concludes, businesses must engage with their shareholders and manage relationships carefully to foster positive outcomes. Continuous monitoring of the competitive landscape will also help to retain investor interest and secure future funding. With thorough preparation and a strategic approach, businesses can turn equity crowdfunding into a viable path towards achieving their financial goals.