Impact of In-App Payments on Small and Medium Enterprises (SMEs)

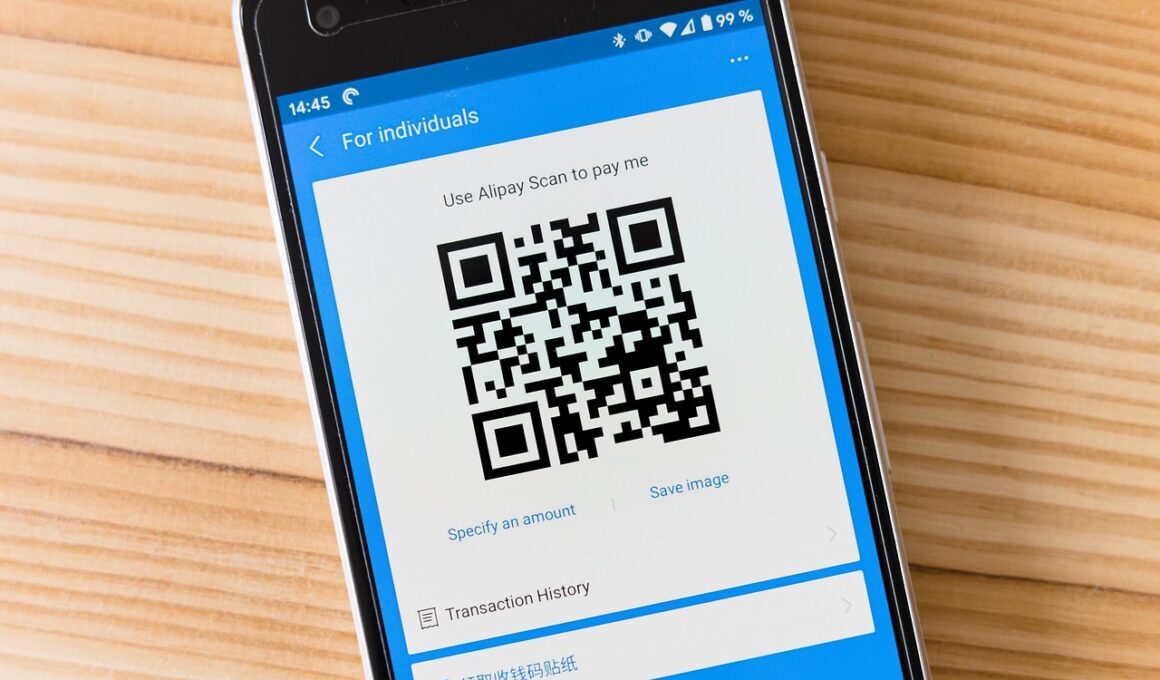

In-app payments have revolutionized how small and medium enterprises (SMEs) conduct their transactions. With the rise of mobile apps, SMEs can offer a seamless shopping experience directly within their applications. This convenience not only enhances customer satisfaction but also drives sales and increases revenue. Implementing in-app payment solutions allows SMEs to streamline their payment process, reducing the likelihood of cart abandonment and improving conversion rates. Furthermore, it provides businesses with valuable customer insights that can help inform marketing strategies. These insights include purchasing behavior, preferences, and demographics. Moreover, in-app payments frequently support multiple payment methods, enabling customers to select their preferred payment option, thus broadening the consumer base. SMEs that embrace these changes are often quicker to adapt to market trends, giving them a competitive edge. The ease of use and accessibility of these payment systems encourage customer loyalty and repeat business, which is especially beneficial for SMEs seeking to establish a solid market presence. In conclusion, in-app payments represent a game-changer for SMEs, fostering not only growth but also sustainability in an increasingly digital marketplace.

Enhancing User Experience

The integration of in-app payments greatly enhances user experience for SMEs, making the purchasing process smoother and more engaging. When customers can make purchases directly within an app, they are more likely to complete their transactions without unnecessary delays. Seamless payment solutions eliminate the need for customers to navigate away from the app or enter their payment details repeatedly. The convenience provided by in-app payments fosters a sense of trust and safety among users, which is critical for customer retention. Furthermore, many in-app payment systems offer stored payment options, allowing repeat customers to check out quickly with just a few taps. This speed is essential in today’s fast-paced environment, where users expect instant gratification. In addition, an intuitive payment interface can significantly reduce customer frustration during the checkout process. The speed and simplicity of in-app payments can lead to increased average order values, as the easier payment process encourages users to purchase additional items. By focusing on customer experience, SMEs can differentiate themselves from competitors, creating a loyal customer base that contributes to long-term growth and success.

As SMEs adopt in-app payment systems, they can also benefit from cost savings and increased efficiency. Traditional payment methods can often incur high transaction fees, which can adversely affect smaller businesses with tighter budgets. However, many in-app payment platforms offer more competitive rates, allowing SMEs to retain a larger portion of their profits. Additionally, the automation of payment processing can free up valuable time and resources that small business owners can invest elsewhere. This not only improves operational efficiency but also allows businesses to focus more on strategic initiatives. Implementation of these payment solutions often comes with robust analytics tools, enabling SMEs to track sales performance easily. This data-driven approach helps identify areas for improvement and fosters better decision-making. Moreover, these insights allow SMEs to tailor their offerings and promotions to better meet customer needs, ultimately boosting revenue. In-app payments can also facilitate access to alternative financing solutions. SMEs using these platforms may qualify for better financing options based on their payment processing data, which is typically accessible through the relevant application.

Security Considerations

Security is a critical concern for SMEs employing in-app payment systems, as data breaches can quickly tarnish a brand’s reputation. Fortunately, most modern payment platforms come equipped with advanced security features, such as encryption and tokenization, to protect sensitive customer information. SMEs must ensure they choose payment processors that comply with industry standards, such as PCI DSS, to safeguard customer data. Providing customers with secure payment options not only builds trust but also enhances brand loyalty. Transparency regarding security measures can reassure customers who may have reservations about online transactions. In addition, SMEs should invest in educating their staff about security protocols and best practices, enabling them to respond effectively to potential threats. Regular audits of the payment system also help identify vulnerabilities that could lead to security breaches. Responsive measures and procedures for handling fraud or data breaches should be established beforehand. By prioritizing security, SMEs can maintain consumer confidence and create a safe buying environment. This focus on security ultimately aids in customer retention and acquisition, contributing positively to the overall business growth and sustainability.

Another benefit of adopting in-app payments is the ability for SMEs to offer loyalty programs and personalized promotions. These features can significantly enhance customer engagement and incentivize repeat business. In-app payment providers can integrate loyalty solutions that reward customers for their purchases, driving customer retention while fostering brand loyalty. Personalization can extend beyond simple discounts; businesses can tailor promotions based on buying habits and preferences, creating targeted marketing initiatives that resonate with individual customers. This level of personalization makes customers feel valued and understood, encouraging continued business. Moreover, SMEs can leverage customer data gathered from in-app payments to create segmented marketing campaigns, significantly improving their conversion rates. As users engage more with the app, businesses can develop tailored experiences that align with customer expectations, further solidifying their connection with users. The integration of these features into in-app payments can turn casual buyers into loyal customers. In making the most of the in-app payment experience, SMEs can thus increase their customer lifetime value, securing a robust and sustainable business future in the competitive digital landscape.

Challenges for SMEs

Despite the numerous advantages, there are challenges that SMEs might face when implementing in-app payment solutions. Among these obstacles are the initial setup costs and technical complexities associated with integrating payment systems into existing applications. Many small business owners may lack technical expertise, necessitating hiring external consultants or developers, which could strain their resources. Furthermore, SMEs need to ensure that all staff are adequately trained on new systems to avoid errors or misunderstandings that could frustrate customers. Addressing these challenges may require a strong commitment of both time and financial resources before SMEs can reap the full benefits. Additionally, the rapid pace of technological change can be daunting; staying updated with the latest innovations in payment systems is crucial. Competition in the app marketplace is fierce, and SMEs must constantly differentiate themselves. The evolving nature of consumer preferences means that businesses have to adapt; this attitude necessitates agility and adaptability. Ultimately, while the road may be challenging, the potential rewards for SMEs utilizing in-app payments are significant and can lead to lasting improvements in their operational models.

In conclusion, the impact of in-app payments on small and medium enterprises is profound. The advantages of compelling user experience, improved operational efficiencies, enhanced security, and personalized marketing strategies together create a holistic beneficial framework for SMEs. Adopting in-app payments is not merely a trend; it has become a necessity for businesses seeking sustainable growth in a digital-first world. With the right strategy and resources, SMEs can position themselves advantageously within the marketplace. Although challenges do exist, the potential to enhance customer engagement and drive sales cannot be overlooked. As SMEs continue to explore innovative technologies, in-app payments will remain a critical component of their business strategies. This approach facilitates not only immediate financial benefits but also long-term relationship building between customers and brands. Investing in in-app payment solutions can ultimately translate to higher customer satisfaction rates and a stronger competitive position. Navigating this landscape may take effort, but the outcome can redefine how SMEs interact with consumers, leading to promising futures in an ever-evolving digital economy.