Risk Mitigation Strategies Enabled by Supply Chain Finance Innovations

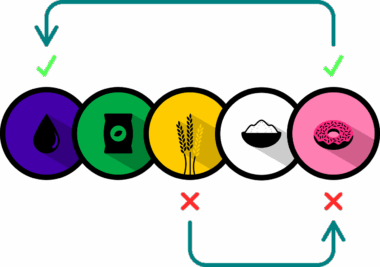

Supply Chain Finance (SCF) has evolved significantly, providing businesses with innovative tools to enhance their liquidity and minimize risks. This transformation allows companies to access finance more efficiently while maintaining healthier balance sheets. The introduction of dynamic discounting, for instance, enables suppliers to receive early payments in exchange for discounts, reducing the cash flow risk for large firms. Additionally, with the rise of fintech startups, technology-driven solutions for supply chain financing have emerged, offering tailored financing options. These solutions enhance visibility across the supply chain, empowering businesses to make informed decisions with real-time data. Furthermore, blockchain technology is being leveraged to create transparent financial transactions, preventing fraud and increasing efficiency in the supply chain. Risk sharing and syndication models also foster collaboration among partners, leading to improved financial stability. The application of advanced analytics assists firms in identifying potential risks early on, allowing for proactive response strategies. Overall, embracing these innovations not only strengthens supplier relationships but also fortifies the financial backbone of organizations. As SCF continues to adapt, strategic integration of these innovations will play a pivotal role in the evolution of the global supply chain landscape, driving agility and resilience.

One critical aspect of Risk Mitigation Strategies in Supply Chain Finance is the focus on supplier risk assessments. Financial institutions and companies are developing comprehensive evaluation frameworks to assess the creditworthiness of suppliers. Such assessments ensure that businesses can make informed financing decisions based on the reliability of their supply chain partners. Furthermore, diversified sourcing strategies, where firms engage multiple suppliers for critical inputs rather than relying on single sources, serve as an essential tactical approach. This diversification reduces the dependency risk and minimizes potential disruptions. Additionally, implementing robust contingency plans becomes paramount in safeguarding operations from unforeseen circumstances. Engaging reputable third-party risk management service providers further strengthens firms’ defensive strategies, helping to analyze market changes and potential risks in a timely manner. Sophisticated risk management tools facilitate better cash flow projections, ensuring that businesses can navigate the uncertainties of global trade. Managing currency fluctuations, credit risk, and geopolitical instability are other vital areas where innovative SCF solutions can play a key role. Firms embracing these proactive methods stand a better chance of enhancing financial resilience and ensuring operational continuity amidst potential disruption.

Technological Contributions to SCF

Digital innovation significantly influences risk mitigation in supply chain finance by improving visibility, efficiency, and accuracy in transactions. Leveraging cloud-based platforms enables organizations to enhance collaboration across their ecosystems. These platforms allow for seamless data sharing among stakeholders, fostering a unified approach towards risk management. With data analytics, businesses can forecast demand and supply fluctuations, thus optimizing inventory levels accordingly. This optimization reduces the chances of overstocking or stockouts, which can lead to financial losses. Automated invoicing and payment systems boost efficiency, resulting in quicker settlements, thereby enhancing cash flow. Moreover, artificial intelligence plays a pivotal role in analyzing vast amounts of historical data, thereby identifying patterns and potential risk indicators that may not be visible through conventional analysis. By incorporating machine learning algorithms, firms can automate risk assessments, enhancing their decision-making processes. Furthermore, by utilizing IoT devices, real-time tracking of goods in transit mitigates risks associated with theft or delays. Ultimately, the integration of advanced technologies within the SCF framework enables businesses to anticipate and respond effectively to emerging risks. These innovations are vital in navigating the complexities of the global supply chain landscape efficiently.

The advent of e-invoicing in Supply Chain Finance has transformed the landscape of financial transactions, leading to significant risk mitigation. By automating invoice generation and approvals, organizations can streamline their processes, eliminating human error scenarios. This automation enhances transparency, as it allows all parties to track the progress of payments in real time. Moreover, e-invoicing reduces the time taken for payments to be processed, positively impacting cash flow management. Organizations that adopt this technology often experience a decrease in transaction costs, further promoting financial stability. In addition to cash management, e-invoicing complies with regulatory requirements, which is crucial for mitigating legal risks. Implementing e-invoicing can also improve supplier relationships since clear transaction records enhance trust and accountability between buyers and suppliers. Companies that utilize such innovative financing solutions often benefit from lower financing costs due to improved efficiencies. As organizations continue to embrace digital solutions, the importance of e-invoicing in mitigating risks can’t be overstated. Investing in technology that simplifies financial processes not only fosters collaboration but also builds stronger transparency across the supply chain, which is essential for long-term success.

Collaboration within Supply Chains

Another fundamental element of effective Risk Mitigation Strategies in Supply Chain Finance is fostering collaboration among trading partners. Businesses that focus on building strong relationships with suppliers, manufacturers, and logistics providers tend to enjoy reduced risks in various forms. Enhanced communication between parties allows for quicker identification and resolution of potential issues, such as supply shortages or quality concerns. This collaboration often extends beyond operational efficiency to include financial aspects, as partners can share risks through collaborative financing solutions. By developing joint financial arrangements, companies can spread risks across the entire supply chain, thus reducing the financial burdens on individual entities. Furthermore, continuous dialogue provides insights into market dynamics, enabling proactive responses to changes. The creation of strategic alliances allows businesses to leverage shared resources and insights, fostering trust and cooperation. Such partnerships are essential for navigating challenges in the supply chain, especially in times of uncertainty. Companies that engage collaboratively showcase resilience and adaptability in mitigating supply chain risks successfully. Hence, prioritizing collaborative efforts within supply chain finance is indispensable for building robust, risk-resilient networks, ultimately securing competitive advantages in today’s volatile marketplace.

Integrating sustainability into Risk Mitigation Strategies is becoming increasingly important within Supply Chain Finance. Companies are recognizing that environmentally and socially responsible practices can significantly impact their risk profiles. By adopting sustainable sourcing methods, organizations can reduce reputational risks while ensuring compliance with regulations. Furthermore, sustainability considerations can enhance operational efficiencies, leading to reduced costs and better resource management. This strategic alignment not only addresses potential risks but also enables companies to meet the growing consumer demand for sustainable products and services. Implementing sustainability-oriented practices contributes to long-term success, as businesses that embrace environmental accountability often achieve better financial outcomes. Additionally, collaborating with stakeholders in sustainability initiatives fosters community trust, which is essential during times of crisis. Moreover, sustainability enhances resilience against regulatory changes, as compliant practices often align with emerging governmental expectations. Integrating sustainability into business practices signifies a proactive approach to risk management. As environmental concerns shape industry standards, firms that fail to adopt sustainable strategies may find themselves exposed to greater risks. Thus, embedding sustainability within Supply Chain Finance strategies is vital for cultivating risk-aware and resilient business operations.

The Role of Regulatory Compliance

Regulatory compliance is a critical component of effective Risk Mitigation Strategies in Supply Chain Finance. As global regulations evolve, companies face the challenge of navigating diverse compliance landscapes that often vary by country. Implementing robust compliance frameworks enables organizations to address these varying requirements, reducing the risk of penalties. Companies can employ dedicated compliance teams that focus on understanding trade regulations and ensuring adherence to financial regulations related to supply chain financing. Frequent audits and assessments further support efforts to identify and mitigate compliance risks. Utilizing technology, such as compliance management software, can streamline processes, ensuring that businesses remain updated with regulatory changes. Additionally, engaging in training programs for employees fosters a culture of compliance. Organizations that prioritize regulatory compliance are less likely to face operational disruptions and reputational risks. Furthermore, strong compliance practices solidify relationships with stakeholders, including banks and investors, positively influencing finance accessibility. In today’s interconnected world, non-compliance can lead to significant financial consequences and operational interruptions. Therefore, integrating compliance into Supply Chain Finance strategies is vital for minimizing risks and ensuring sustainable, long-term success across global markets.

The journey of implementing effective Risk Mitigation Strategies through Supply Chain Finance innovations is multifaceted. Organizations must continuously evolve and adapt to changing market dynamics while leveraging technological advancements to enhance their risk management frameworks. Firms that invest in technology and innovative practices tend to have a competitive edge in identifying and mitigating supply chain risks. Collaboration, data-driven insights, and sustainability all play pivotal roles in developing a resilient supply chain. Investment in training and continuous improvement initiatives ensures that employees remain skilled in navigating these complexities. By embedding risk management at the core of supply chain finance strategies, organizations can secure long-term stability and success against an unpredictable marketplace. As supply chain finance continues to evolve, embracing innovation will shape the future of risk management. Therefore, organizations must remain proactive in adopting new technologies and methodologies that contribute to enhanced financial resilience. Ultimately, the collective efforts towards innovative and strategic risk mitigation will define the pathways for overcoming future challenges. Businesses ready to embrace these methodologies will thrive, secured from the uncertainties of the ever-changing global business environment. The commitment to risk mitigation will ensue as a primary catalyst in achieving sustainable growth in the rapidly changing supply chain scenarios.