Equity Crowdfunding Regulations: What Investors Need to Know

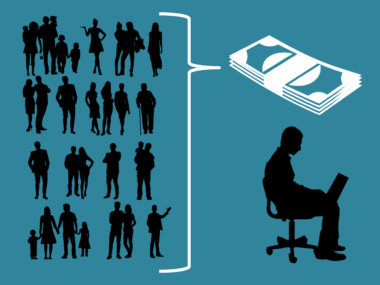

Equity crowdfunding has emerged as a powerful tool for businesses seeking financing while allowing investors to partake in potential profits. Understanding equity crowdfunding regulations is crucial for both parties involved. Regulatory bodies, such as the SEC in the United States, provide guidelines that ensure transparent operations. These regulations require companies to disclose critical information like financial statements, business plans, and the use of raised funds. These disclosures help investors make informed decisions about their investments. Furthermore, compliance with regulations protects investors by diminishing the likelihood of fraud. When businesses comply with the law, they also instill trust among potential investors. Investors should be aware of the limits placed on investments to ensure they do not exceed their financial capacity. For instance, some regulations stipulate that only accredited investors can invest in certain fundraising campaigns. Others provide specific thresholds depending on an individual’s income and net worth. Careful consideration of these limits and responsibilities ensures that equity crowdfunding remains a viable option for passionate backers eager to support innovative ventures. Thus, staying updated on these regulations is in every investor’s best interest.

Understanding the Role of Investors

For equity crowdfunding to function effectively, the role of investors is paramount. Investors not only provide essential funds but also gain ownership stakes in the startups they support. This ownership often comes in the form of shares, which allow investors to experience potential appreciation in value as the business grows. However, with ownership comes responsibility: investors must make informed decisions based on the information presented by businesses in their funding campaigns. Comprehensive knowledge of the investment landscape is crucial for minimizing risks. As startups usually have less financial history, due diligence becomes vital for an investor’s success. Many crowdfunding platforms offer tools and resources that assist investors in assessing business proposals, including industry comparisons and performance indicators related to startups. Potential investors should participate in community discussions and seek advice from experienced individuals in the field. Robust investor education not only empowers individuals but also contributes to the overall stability of the equity crowdfunding environment. Moreover, regulations encourage optimal transparency in these discussions, allowing everyone to enjoy the advantages associated with equity crowdfunding while remaining protected.

The Importance of Due Diligence

Conducting thorough due diligence is essential when participating in equity crowdfunding. This involves scrutinizing the details presented in a business’s crowdfunding pitch and evaluating its viability. Investors should look beyond promising projections and consider the fundamentals, such as management experience, product-market fit, and competitor landscape. Assessing a startup’s business model and financial health also plays a significant role in decision-making. Understanding the founding team’s track record, commitment to the venture, and vision can offer crucial insight into potential success. Furthermore, reviewing the market opportunity and demand for the startup’s product or service is essential. A vibrant market environment can catalyze growth, while stagnant industries may provide limited prospects. It’s also wise for investors to compare similar ventures within the same sector, examining their funding success and growth trajectories. Diligent investors often utilize both qualitative and quantitative analysis to form a comprehensive view. In addition, leveraging professional platforms and forums can yield valuable insights. Ultimately, effective due diligence acts as a protective mechanism that enhances the chances of successful investments and minimizes potential losses in the equity crowdfunding space.

In addition to understanding due diligence, investors should be aware of the various platforms available for equity crowdfunding. These platforms serve as the intermediary between startups and investors. They help startup companies reach a broader audience and facilitate the investment process. Some of the most well-known equity crowdfunding platforms include SeedInvest, Wefunder, and Crowdcube, each offering unique features and regulatory compliance standards. Selecting the right platform requires that investors consider factors such as fees, available investment opportunities, and the level of due diligence performed by the platform itself. Furthermore, reputable platforms often vet businesses before they go live, providing an additional layer of protection for investors. However, investors should still conduct their research while evaluating opportunities listed on any platform. It’s advantageous for investors to look for platforms that have a proven track record of successful investments and positive investor feedback. Additionally, being part of a platform community can enrich investors’ understanding of emerging trends and market shifts within the equity crowdfunding landscape. Ultimately, the right platform can enhance the investment experience, contributing to successful outcomes for investors and startups alike.

Legal Considerations of Equity Crowdfunding

Legal considerations surrounding equity crowdfunding can significantly impact investment decisions. With various regulations implemented by governing bodies, compliance becomes a primary concern for both startups and investors. Awareness of rules regarding how much capital can be raised, the types of investors allowed, and mandated disclosures ensures that parties remain compliant. In the United States, the JOBS Act plays a critical role in defining these regulations. It permits private companies to engage in crowdfunding while still subject to specific requirements tailored to protect investors. Additionally, international regulations may differ substantially, necessitating that investors understand local laws when considering opportunities abroad. Consulting legal professionals knowledgeable about crowdfunding regulations can help investors avoid potential pitfalls. This proactive approach not only safeguards investments but also encourages responsible practices within the equity crowdfunding ecosystem. Furthermore, when startups and investors prioritize legal compliance, they enhance overall trust and collaboration in the funding process. This enables a healthier crowdfunding environment, fostering innovation and growth for all stakeholders involved. Thus, understanding these legal factors is essential to ensuring profitable equity crowdfunding ventures.

In conclusion, understanding equity crowdfunding regulations is vital for any investor looking to navigate this dynamic landscape successfully. The interplay between investors, startups, and regulatory bodies creates a complex environment requiring diligence, research, and ongoing education. Investors must take the initiative to familiarize themselves with the opportunities and risks associated with equity crowdfunding. Grasping the legal framework surrounding investments, including limitations and disclosure requirements, cultivates informed participation. Furthermore, leveraging resources available on crowdfunding platforms enhances confidence and promotes strategic decision-making. Moreover, building connections within the equity crowdfunding community can provide invaluable insights and support. Accessing tools and resources for due diligence empowers investors to explore and assess potential opportunities effectively. Ultimately, equity crowdfunding can be a rewarding experience, providing access to promising startups while supporting innovation and entrepreneurship. Embracing these regulations, best practices, and legal obligations will help create a prosperous environment for all stakeholders, balancing risks and rewards. As equity crowdfunding continues to evolve, staying informed about trends and changes in regulations remains crucial for success in this captivating investment frontier.

Equity crowdfunding has emerged as a powerful tool for businesses seeking financing while allowing investors to partake in potential profits. Understanding equity crowdfunding regulations is crucial for both parties involved. Regulatory bodies, such as the SEC in the United States, provide guidelines that ensure transparent operations. These regulations require companies to disclose critical information like financial statements, business plans, and the use of raised funds. These disclosures help investors make informed decisions about their investments. Furthermore, compliance with regulations protects investors by diminishing the likelihood of fraud. When businesses comply with the law, they also instill trust among potential investors. Investors should be aware of the limits placed on investments to ensure they do not exceed their financial capacity. For instance, some regulations stipulate that only accredited investors can invest in certain fundraising campaigns. Others provide specific thresholds depending on an individual’s income and net worth. Careful consideration of these limits and responsibilities ensures that equity crowdfunding remains a viable option for passionate backers eager to support innovative ventures. Thus, staying updated on these regulations is in every investor’s best interest.

Understanding the Role of Investors

For equity crowdfunding to function effectively, the role of investors is paramount. Investors not only provide essential funds but also gain ownership stakes in the startups they support. This ownership often comes in the form of shares, which allow investors to experience potential appreciation in value as the business grows. However, with ownership comes responsibility: investors must make informed decisions based on the information presented by businesses in their funding campaigns. Comprehensive knowledge of the investment landscape is crucial for minimizing risks. As startups usually have less financial history, due diligence becomes vital for an investor’s success. Many crowdfunding platforms offer tools and resources that assist investors in assessing business proposals, including industry comparisons and performance indicators related to startups. Potential investors should participate in community discussions and seek advice from experienced individuals in the field. Robust investor education not only empowers individuals but also contributes to the overall stability of the equity crowdfunding environment. Moreover, regulations encourage optimal transparency in these discussions, allowing everyone to enjoy the advantages associated with equity crowdfunding while remaining protected.