Case Studies: Successful Digital Identity Management Implementations in Finance

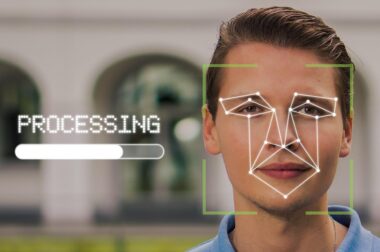

In the rapidly evolving financial sector, effective digital identity management has become crucial for ensuring security and compliance. One notable case study involves a leading bank that revamped its online banking platform by integrating a robust digital identity solution. This implementation focused on verifying customer identities through biometric data including face recognition and fingerprints. Furthermore, the bank utilized a multi-factor authentication (MFA) system which required users to verify their identity with additional information. This significantly minimized cases of unauthorized access and fraud, striking a balance between security and user experience. Additionally, the bank adopted a centralized identity management system which streamlined the onboarding process. Customers enjoyed a smoother user experience while maintaining stringent security protocols. The project led to increased customer satisfaction and trust as their sensitive information remained protected. Senior executives noted a 30% reduction in fraudulent transactions. They were particularly pleased with the performance metrics following the deployment. Overall, investing in advanced digital identity management technologies has proven to be essential for financial institutions aiming to safeguard data while fostering customer loyalty and ensuring compliance with regulatory requirements.

Enhanced Security Protocols in Digital Banks

Another exemplary case involved a digital-only bank that recognized the need for a resilient digital identity framework from its inception. This financial technology startup implemented innovative solutions to tackle identity fraud head-on. Initially, the bank established a solid identity verification process that included checks against government databases and real-time identity verification algorithms. By leveraging artificial intelligence, they were already able to detect and prevent suspicious activities instantly. The result was a highly secure environment that mitigated risks associated with digital banking. The use of blockchain technology further enhanced the integrity of identity transactions, allowing customers to securely manage their own identity data. Importantly, a user-centric approach was prioritized, leading to a seamless onboarding process that required minimal hassle. The startup’s commitment to transparency and data privacy along with stringent compliance measures led to rapid growth in customer acquisition. By offering robust security alongside user-friendly services, the digital bank achieved a remarkable 40% growth in customer trust, significantly outperforming traditional banking institutions. This case demonstrates how advanced digital identity solutions can create a secure, reliable banking environment for customers who prioritize safety.

In another successful implementation, a global investments firm recognized the critical importance of digital identity management to meet regulatory requirements while simplifying workflows. The firm adopted a comprehensive identity management platform that integrated seamlessly across their operations. A key feature was the ability to perform real-time identity checks, ensuring that all employees and contractors met compliance standards. This approach not only enhanced internal security but also streamlined onboarding processes, enabling quicker access to necessary systems and information. Security roles were defined clearly within the framework, which assisted in reducing human error and unauthorized access risks. The implementation led to an environmentally friendly transition, significantly cutting down on paper-based identity verifications. With better reporting capabilities, compliance teams could address regulatory changes promptly, fostering an adaptable operational environment. Post-deployment assessments showed a 25% decrease in onboarding times, allowing quicker project completion. Clients also began noticing a rise in data accuracy and integrity for their portfolios. Ultimately, this case illustrates how financial firms can thrive by investing in comprehensive digital identity management strategies that both enhance workflow efficiency and ensure compliance adherence without compromising security.

Customer-Centric Identity Solutions

A prominent insurance company undertook a significant digital transformation journey, placing a strong emphasis on enhancing their digital identity management practices. The primary focus was on establishing a seamless identification process for their diverse customer base, which included both individual clients and corporate entities. To achieve this, the company integrated a customer-centric identity solution that prioritized user experience. This involved utilizing mobile technology for identity verification, allowing clients to submit documents via dedicated mobile applications. Clients could now experience expedited policy applications and claims processing with fewer unnecessary bottlenecks. The system employed advanced encryption methods to secure sensitive customer data while maintaining compliance with regulatory requirements. As a result, customer engagement scores improved notably. They experienced a 30% increase in customer retention rates after the implementation. Regular feedback collection and iterative improvements ensured that the digital identity management system continued to meet evolving client needs. This case demonstrates that focusing on user experience in identity solutions not only meets security needs but contributes positively to customer loyalty while improving operational efficiencies as well.

In yet another scenario, a multinational corporation specializing in wealth management faced challenges with exposing sensitive client information without a solid digital identity infrastructure. Their approach focused on incorporating advanced digital identity management solutions that ensured comprehensive visibility and security for client data. They deployed an identity access management system that enabled different levels of access for employees according to their roles. Employees were able to efficiently handle client inquiries while safeguarding proprietary and confidential information. Client trust was enhanced due to transparent control over who accessed their information and why. Additionally, the implementation incorporated advanced analytics and reporting features that monitored identity usage in real-time. Insights gained from these analytics informed management decisions and optimized engagement strategies. Post-implementation reviews revealed a significant reduction in information breaches and mishandling incidents, with an impressive 35% drop in reported security issues. Additionally, the implementation led to improved training efforts, as employees were more aware of personal responsibilities regarding data protection. This highlights the crucial role of innovative digital identity management solutions in maintaining client trust within the competitive landscape of wealth management.

Future Trends in Digital Identity Management

Looking ahead, insights from various case studies suggest several key trends that will shape the future of digital identity management in finance. One notable trend is the ongoing integration of artificial intelligence to enhance fraud detection mechanisms. Financial institutions will increasingly leverage machine learning algorithms to analyze vast amounts of data, identifying patterns indicative of fraudulent behavior swiftly. Additionally, as consumer privacy concerns grow, a shift towards decentralized identity solutions is expected. These solutions will grant customers greater control over their identity information while minimizing exposure to risks. Furthermore, regulatory bodies are likely to continue adjusting compliance frameworks to meet the speed of technological advancements, requiring a proactive response from financial institutions. Another emerging trend is the consolidation of identity services across industries, as financial entities collaborate with technology companies to create more holistic approaches to identity management. The importance of user experience will remain paramount, driving the development of intuitive interfaces. Overall, keeping an eye on these trends ensures financial institutions remain competitive in a landscape constantly evolving in response to technological advancements and consumer expectations.

The cases highlighted illustrate that successful digital identity management significantly enhances security and efficiency within financial sectors. By adopting innovative and customer-centric practices, financial institutions can build trust with clients while meeting regulatory standards. Each implementation demonstrates the necessity of embracing advanced technologies to secure sensitive information effectively. Furthermore, fostering a culture of continuous improvement helps institutions stay adept in adjusting to evolving threats and client expectations. Financial firms willing to invest in molding secure identity management strategies will stand out positively in a competitive market. Through lessons learned from these success stories, organizations can focus on establishing tailored digital identity solutions. This approach not only safeguards critical assets but also allows institutions to streamline operations, ultimately providing enhanced service offerings. As these case studies reveal, the pathway toward successfully adapting to digital identity management involves collaboration between regulators, clients, and technology providers. Progressing effectively towards secure digital strategies will empower financial businesses to navigate the complexities associated with identity management in an increasingly digital world.

The cases highlighted illustrate that successful digital identity management significantly enhances security and efficiency within financial sectors. By adopting innovative and customer-centric practices, financial institutions can build trust with clients while meeting regulatory standards. Each implementation demonstrates the necessity of embracing advanced technologies to secure sensitive information effectively. Furthermore, fostering a culture of continuous improvement helps institutions stay adept in adjusting to evolving threats and client expectations. Financial firms willing to invest in molding secure identity management strategies will stand out positively in a competitive market. Through lessons learned from these success stories, organizations can focus on establishing tailored digital identity solutions. This approach not only safeguards critical assets but also allows institutions to streamline operations, ultimately providing enhanced service offerings. As these case studies reveal, the pathway toward successfully adapting to digital identity management involves collaboration between regulators, clients, and technology providers. Progressing effectively towards secure digital strategies will empower financial businesses to navigate the complexities associated with identity management in an increasingly digital world.